Digital transformation that actually works

We build digital solutions that help businesses run smoother, respond faster, and grow stronger. INDUSTRIA is an international system integrator working at the crossroads of digital infrastructure, AI, and industrial automation. We operate across the UK, the EU, and beyond, delivering reliable, mid-size technology projects that create measurable impact.

Who We Are: The INDUSTRIA Approach to Technology

INDUSTRIA Technology brings together deep engineering expertise with pragmatic business understanding. Over the years, we’ve worked with organisations in finance, logistics, manufacturing, healthcare, energy, and the public sector. Our teams design, build and integrate systems that improve efficiency, unlock new capabilities, and help companies stay competitive in an increasingly complex world.

We operate in a mid-size project segment — large enough to move the needle, but focused enough to care about the details. We’re comfortable sitting between established global players and niche specialists, translating strategy into practical digital infrastructure.

Our work stretches from enterprise software and industrial IoT to AI-driven analytics and process orchestration.

Our clients

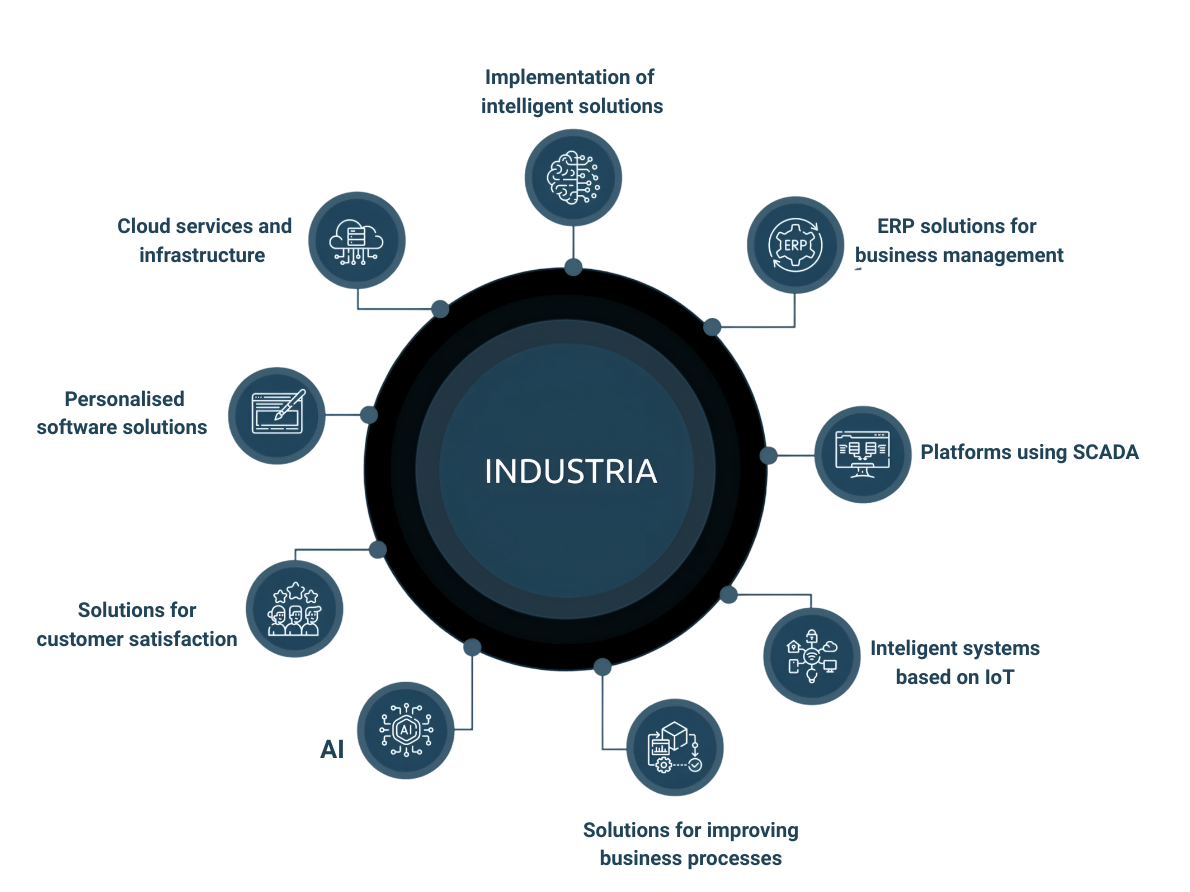

Our solutions

We streamline operations and drive productivity through technology-driven services. By aligning innovation with your specific goals, we transform workflows for maximum efficiency. Our expertise spans manufacturing, logistics, healthcare and more, delivering solutions such as:

- ERP systems to manage all aspects of the business

- Intelligent Manufacturing Solutions

- Industrial computing platforms using SCADA

- IoT-based intelligent control systems

- Business Process Improvement Solutions

- Artificial Intelligence

- Solutions to gain customer satisfaction

- Custom Software Solutions

- Cloud Services and Infrastructure

Staff shortages

By introducing solutions that compensate for staff shortages through automation.

Expertise and Knowledge

By implementing the latest technologies, we help businesses be leaders in their field.

Quality Improvement

We implement quality improvement systems minimizing defects, increasing competitiveness and customer satisfaction

Improving efficiency

We optimize processes to increase profitability and reduce operating costs.

Challenges

The biggest challenges we can overcome using our software and hardware solutions are:

Real Stories. Proven Results.

Concepts are great, but execution is everything. Explore our library of success stories to see how we’ve helped industry leaders navigate complex challenges, optimize their operations, and achieve measurable growth. See the specific strategies we used to turn vision into reality.

Contact INDUSTRIA

Get in touch with us to discuss how we can help your business. As partners, we will discover together the solutions that will enable it to reach new heights through modern technologies and personalized approaches.

86-90 Paul Street London, United Kingdom, EC2A 4NE

+44 203 870 2445 sales@industria.tech

CONTACT US